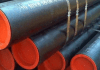

Oil costs are at seven-year highs, with the price of West Texas Intermediate crude, the US benchmark, up 70 p.c this 12 months, at greater than $80 per barrel. It’s a part of a worldwide power crunch that’s pushing costs larger for all sorts of fuels, together with pure gasoline and coal, the DealBook publication experiences.

Many Wall Road forecasters imagine oil costs are about to peak. Oil use is up from 2020 however under what it was in 2019, when oil costs had been decrease than they’re now. Analysts at Goldman Sachs predicted final week that the worth of a barrel of oil might common $85 for the subsequent few years.

However some merchants are betting that oil will rise far more. Essentially the most extensively held possibility is one which pays out if oil rises larger than $100 a barrel by the top of December. Choices trades with strike costs as excessive as $200 by the top of subsequent 12 months have additionally been made currently.

Who is correct? The query of whether or not oil costs have practically peaked or are about to rise a lot larger rests on what’s driving them up within the first place. Two prospects:

-

Quick-term, pandemic-induced disruptions: Demand for oil — like the marketplace for many items — is rising quicker than producers can ramp up provide (or, within the case of the Group of the Petroleum Exporting International locations, are prepared to). If that’s the case, oil costs are most likely close to their highs. With China’s financial system slowing and the U.S. restoration hitting a weak patch, oil demand isn’t prone to develop very quickly within the close to future. That ought to give provide time to catch up, particularly as pandemic disruptions fade.

-

An extended-term mismatch between provide and demand rooted in local weather change: A current report from the Worldwide Power Company discovered that to ensure that nations like the US to grow to be carbon impartial by 2050, oil use should peak by 2025. But, based mostly on present investments, inexperienced energy era received’t be sufficient to supplant oil consumption till 2035. This 12 months’s worth bounce might be the market’s warning signal about future power crunches and worth spikes.